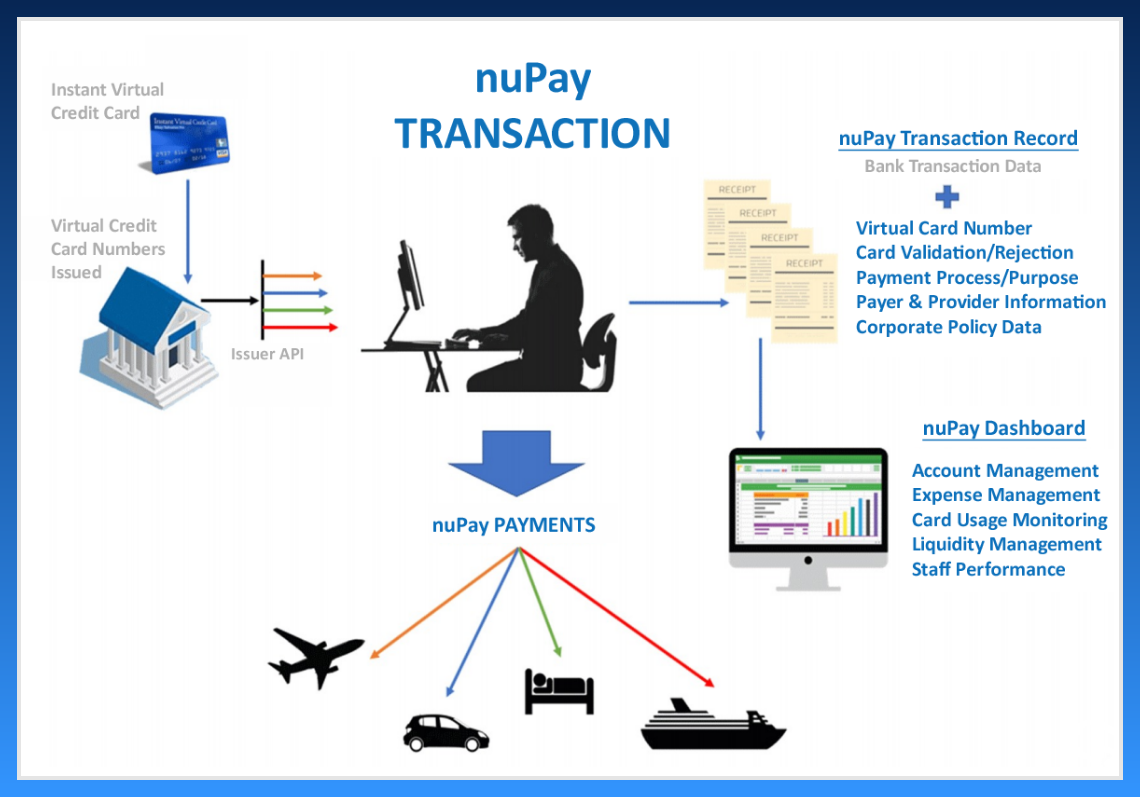

nuPay software sits between the bank and your payment system. Instead of paying providers with a plastic credit card, nuPay uses a Virtual Credit Card. Every payment made on nuPay uses a different credit card number (“Virtual Account Number” or VAN) which expires immediately when funds are transmitted for payment. The VAN increases security and is used by nuPay as a unique ID for every payment. As a Supplier, Airlines, or other creditors, will no longer need to monitor and manage agency limits or assume distribution risks or agency viability impact. More importantly, invoice-to-cash delays can be reduced to days instead of weeks. Additionally, providers can realize the same benefits as their clients using nuPay for themselves. Every company makes payments to suppliers and service providers. How payments are made and what information is retained impacts just about every other function in the company from accounting to customer service and especially the management of day-to-day operations. Streamlining, and automating payments can significantly reduce operational costs and provide a suite of powerful management tools to optimize and control credit usage, liquidity, staff balancing, and quality of service. Being positioned between a new Credit Issuer and your existing accounting system, NuPay can add transaction-related information to payments that can be used to increase efficiencies across the entire organization. NuPay combines FinTech Virtual Credit Card and Accounting technology with a travel-centric automated payment process to simplify, streamline, and reduce staff and management time required to maintain cost-effective online credit payments. With the gains from virtual account payments, companies can expand the number of forms of payments available to customers to increase overall customer acceptance and sales. nuPay uses payment virtual account numbers as a Transaction Identifier (ID). In addition to the normal transactional information provided by the bank, nuPay adds staff and process-related information, time stamps, etc. that are used to simplify reconciliation, resolve billing problems, and track staff proficiency. Any number of different types of information can be added including documents, invoices, and form of payment which can be used for market analysis, customer preferences, revenue capture, and other management analysis and control. Making payments with nuPay eliminates physical plastic cards which eliminate inappropriate personal use, card loss, or theft. Because nuPay separates card possession from use, multiple people can make payments from multiple locations at the same time against the same Funding Account. Travel employees address an average of ten billing and payment issues every day. Labor costs can be impacted instantly with nuPay. Providers will also experience benefits from payer nuPay implementation that will strengthen the business relationship between both parties, even making the payer the client of choice and differential treatment. Optimized, streamlined, and automated payments Information added to every transaction provides managers with a suite of previously unavailable reports to manage day-to-day operations and develop long-term strategies. Smoother Reconciliations with drill down problem identification and resolution Improved Credit Card Monitoring and Limit Control Improved credit reporting for cash and liquidity management Analysis of payments by payer, purpose, branch, currency, etc. Increased staff effectiveness and efficiencies requiring lower skill levels and less resources. The more powerful a user’s reporting capabilities are, the more effective nuPay will be as a management tool. Being able to process and access information in real-time greatly enhances the value of data on an as-needed basis. TRAACS – Nucore’s accounting system that serves as the foundation of Nucore’s Agency Management Platforms – maximizes nuPay’s value with an on-demand and real-time accounting system. nuPay and TRAACS were made for each other, literally, as well as figuratively. nuPay’s value is increased by TRAACS’ extensive library of standard reports and financial statements. TRAACS’ ability to create and save customized reports enables management to use nuPay’s payment information as soon as transactions are completed. Together, nuPay and Nucore’s management platforms maximize the user benefits of FinTech advances.

What is nuPay?

What can it do for my company?

FinTech comes to the Travel Value Chain.

How does nuPay Work?

nuPay returns benefits to payers and providers:

More important are the cost and

sales benefits nuPay delivers Payers:

nuPay also delivers benefits to Supppliers:

nuPay Benefits

nuPay and TRAACS –

Made for Each Other